Investing our Money

I am not an expert in investment matters. Listed here are just some basic information for the general public, to the best of my knowledge. For quick reference only. I do not encourage investing what we cannot afford to lose.

|

Types |

Work |

Returns |

Risks |

|

Cryptocurrencies |

High |

High |

High |

|

Stocks / Shares |

High |

High |

High |

|

Unit Trusts |

Low |

High |

High |

|

Bonds |

Low |

Medium |

Medium |

|

Endowment |

Low |

Low |

Low |

|

Savings |

Nil |

Negative |

Nil |

|

CPF (Singapore) |

Nil |

High |

Nil |

Work : The amount of research, monitoring, follow-up required.

Returns : The amount of probable profit as a percentage

of what was invested.

Risks : The probability of losing all or a big

part of what was invested.

- Cryptocurrencies are digital money. The price can fluctuate very fast due to speculative investments. Some people see it as a good long-term investment though.

- When we buy shares, it is like owning part of the company. The price of the shares goes up or down depending on how the company is doing. Stocks is a collective term for shares (I think).

If you want to try stocks/shares, you can start with blue chip stocks or growth stocks. Blue chip stocks are companies that have been around for very long and are relatively stable, but their growth may be slow. Growth stocks are companies that are in popular/trending sectors and are growing very fast. But do bear in mind that these are very sensitive to economic situations.

- Unit trusts are collective investments, managed by a fund manager. When invested at the wrong timing due to sudden shifts in economic situations, one can lose a lot of money here.

- Buying bonds is like lending money to the buyer. The safer ones are government bonds.

- An endowment policy is a life insurance plan. I take them up mainly as long term saving plans. We get protected and yet save. The returns are moderate, but they are relatively stable and the probability of a gain is high in the long run.

- Normal savings accounts in the bank gives us negative returns because the bank interest rates are likely to be lower than the rate of inflation. We can keep some money in savings account for liquidity (emergency/daily use) but don't put all the money here.

- For those of us who are super low risk-takers, we should at least put the money in fixed deposits (fixed duration of between one month to a few years), but these are also not giving high interest rates nowadays.

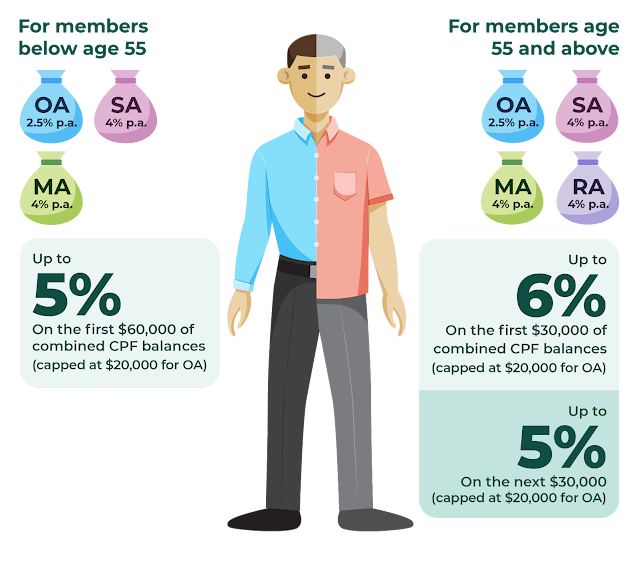

- For Singapore citizens, the best place to keep the money is in CPF (Central Provident Fund), which gives high returns (up to 6% for those above 55 years old) yet low risk.

I reiterate, investing is like gambling. Do not play with what we cannot afford to lose. It would be good to have someone trusted to be our financial consultant, someone who advises us based on our needs, not based on their probable commissions.

Do not try on-line investments where we do not know who is on the other end. Many are scams.

P/S: The $10,000 note on the cover pic was from a newspaper advertisement long ago. Singapore has stopped printing the $1,000 and $10,000 notes, but these currencies are still legal tender.

Comments

Post a Comment