CPF

Pic: Taken from the CPF website.

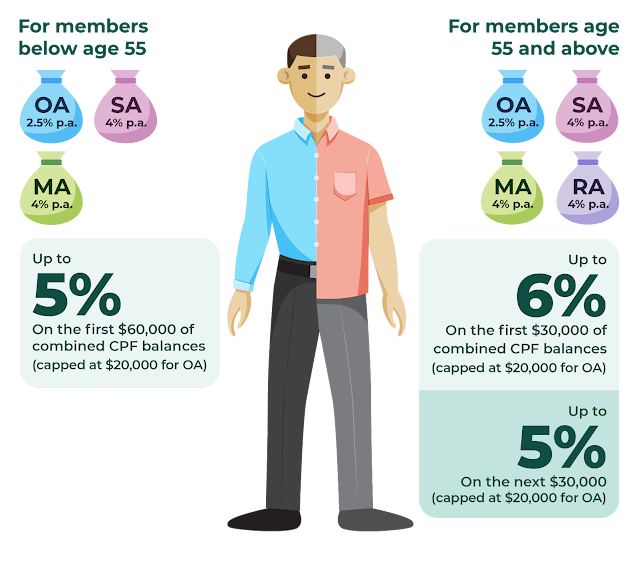

In Singapore, we have the Central Provident Fund (CPF), which is a compulsory savings through own and employer contribution during our working years, to provide us for our golden age.

This post lists some information for younger Singapore citizens, as a quick reference. The info is accurate (to the best of my knowledge) as of the posting date.

Before 55 years old:

1. Try to achieve the required Full Retirement Sum (FRS) early. The main purpose is not about wanting to retire early, but to take advantage of the high/good interest rates offered in CPF. The amount is compounded, and will be a huge sum by the time we are 55.

2. We can achieve the above by various methods, like low-to-medium risks investments using Ordinary Account and/or Special Account (OA/SA), or through voluntary top-ups. Of course, we need to work very hard and impress our boss so that we get our promotions, higher salary and bonuses that comes with that (higher salary means more contributions into the CPF).

On 55th birthday:

3. A Retirement Account (RA) will automatically be created for us. Part of our OA and SA will be transferred to the RA to form the FRS (assuming we have more than the required FRS by the time we are 55).

4. Any remaining amount in the OA and SA (after setting aside the FRS) can be withdrawn for personal use, through PayNow in the CPF App/Website. However, my advice is, do not withdraw unless really necessary, so as to, again, take advantage of the high interest rates. (remaining sums in SA will be shifted to OA upon 55 years old, wef 2025).

5. We can, of course, go for a well-deserved holiday, but we should continue working. This is to continue building our nest egg. If we decide to retire early, we may find ourselves very bored after a while, and the only thing we could do is to spend money. This is not wise. It is good to keep working to keep our mind working too.

Before 65th birthday:

6. We will need to decide on a few things.

6.1 What age we want to start drawing out the monthly CPF-Life payout. The earliest is at 65 years old. If we do not decide/inform, CPF Board will start our payout automatically when we turn 70.

6.2 What type of payout we prefer (Escalating, Standard, or Basic).

Escalating: increasing amount of payout

Standard: same amount of payout throughout

Basic: decreasing amount each year, but the bequeath will be better

6.3 How much you want in your RA to start your payout (Basic Retirement Sum, Full Retirement Sum, Enhanced Retirement Sum).

Basic: more cash in hand, but lower monthly payout from CPF

Enhanced: less cash in hand, but higher monthly payout from CPF

For details, please refer to the CPF website.

Comments

Post a Comment